Bill Pay Service to Put YOUR BUSINESS FIRST

We have exciting news! As of July 23rd, 2020, we will be introducing our new and improved Business Online Bill Pay service to provide you with enhanced reliability, security, and more features to put YOU FIRST.

Want to see all the new features?

Your New and Improved Business Bill Pay

Frequently Asked Questions

Why Can I Not Access the New Platform?

If you are having trouble accessing our platform, please make sure your internet browser's security settings are up-to-date. Need help with your browser settings? Click here for step-by-step instructions.

What Information Will Be Transferred?

Your current customer setup, payee contact, and account information will be automatically transferred to the new online bill pay system, and you will not need to re-enter this information. In addition, your scheduled one-time and recurring payments will also be transferred.

Who to Contact for Questions:

Should you have any questions or concerns regarding the Business Bill Pay service, please feel free to contact Client Support at 877-627-7201. Thank you for choosing First Financial Bank. We look forward to better serving you with our new and improved platform!

What is Different?

Funds verified and collected on process date instead of due date.

We are moving to a prefunded model such that any electronic payment will be collected from the account the day before it is due which is considered the process date. If the money is not available on that date, you will receive an email letting you know the payment failed and was rescheduled to the next day. The system attempts for 3 days (process date and 2 additional business days) to collect the money (checking at 7am and 2pm CT) and send the payment before it cancels.

Checks are not prefunded, since the money comes out of the account when the check clears, if funds are available. If a check is lost, a normal stop payment, like on any of your accounts, needs to be placed on the bill pay check since it is written off of your account. Research is just like all others checks as well.

Basic package includes 25 bill payments and/or payments via direct deposits for free and $0.95 for each additional. You can have 1,000+ payees, the fees are based on payments processed. Or, ask about our Business Online Banking Enhanced package with 50 bill payments included, PLUS the Optional Small Business Payroll Feature for a small fee.

Inactivity fee of $4.95, after 12 consecutive months of non-use.

We are loading Bill Pay Checks written to Positive Pay, if the account is set up to use that system. We will add the Sending Company ID for the electronic payments to our global ACH Filter “pass” list. This means bill payments should not become exceptions.

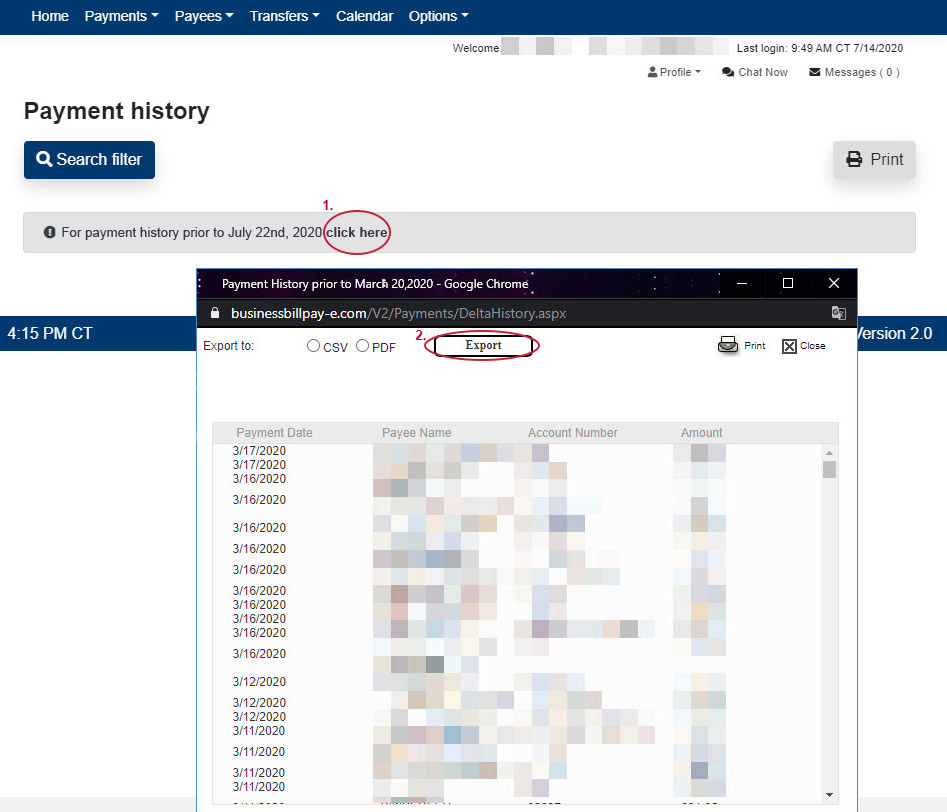

History prior to July 23rd, 2020 will be viewable in a special report, separate from history originated in the new system. See the image below to view the steps for exporting payment history. Once exported you may save or print the information.

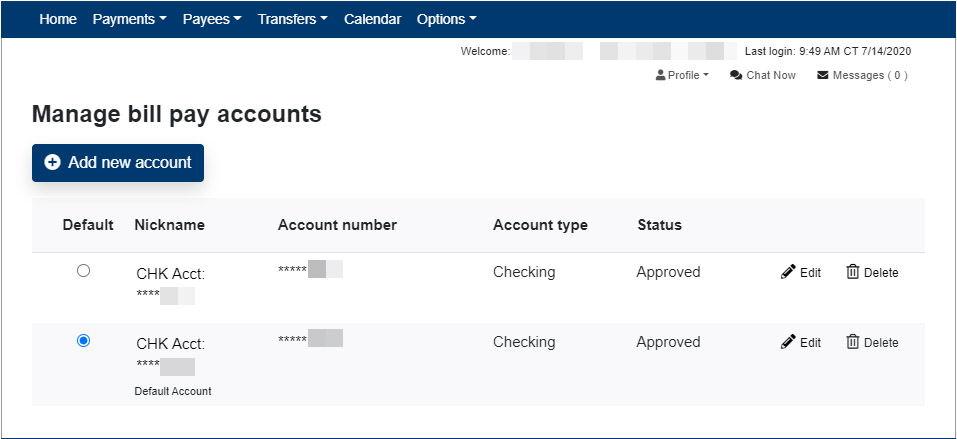

When you add new accounts to bill pay, we must approve that account being added. We will require the account be setup in Business Online Banking to be added, and of course, you must be an owner/signer of that account to add it.

Dual approval can be turned on for bill pay. It is managed by the Admin in the bill pay system.

Pay From Accounts can only be checking accounts. Savings accounts are not valid bill pay accounts.

Post conversion, some payees that are were electronic before may become check payments in the new business online bill pay. This could depend on whether the new bill pay has the payee’s bank account information. This could also mean the address used when setting up the payee was not a match on the new business bill pay.

With the current business online bill pay, an electronic payment that was $10,000 or over, triggers a conversion to a check payment instead of an electronic payment. However, in new business bill pay, we do a funds verification on processing day before sending the electronic payment. If funds are available, the memo debit will be placed, and the electronic payment sent; no more converting to check because of the amount of the payment.

New Features

Feature Available | Current Feature | New Feature |

Receipt of Online Bills with The Ability to Review | ✔ | ✔ |

Scheduling Options for Variable and Recurring Payments | ✔ | ✔ |

Payment to Anyone, Anytime, Anywhere in The US And Puerto Rico | ✔ | ✔ |

Ability to Add, Change, Delete, And Organize Payees | ✔ | ✔ |

Reviewing Pending Payments | ✔ | ✔ |

Expedited Payments | ✔ | ✔ |

User Friendly Payment Center to Manage All of Your Bill Payment Activity on One Screen | ✔ | ✔ |

Bill Reminders to Notify You When A Bill Needs to Be Scheduled, Or A Payment Was Paid | ✔ | ✔ |

Calendar Feature to Assist You in Identifying the Earliest Available Payment Date | ✔ | ✔ |

Additional Payment Options | ✘ | ✔ |

| ✘ | ✔ |

| ✘ | ✔ |

Positive Pay Integration | ✘ | ✔ |

| Ability to Select Appropriate Business Title For Payments | ✘ | ✔ |

| Ability to Add and Manage Bill Pay Funding Accounts and Nicknames | ✘ | ✔ |

Optional Small Business Payroll Feature – Offers a prefunded low volume way to direct deposit to employees. *Requires Activation | ✘ | ✔ |

Preparing for the Conversion: A Timeline

Date | Current Business Bill Pay | New Business Bill Pay |

By July 17, 2020 | Print or export any bill information you wish to retain for your records | |

| By July 20, 2020 at 2:00 PM | Pay any bills due on or before July 23, 2020 | |

| July 2020, 2020 at 7:00 PM | WILL NO LONGER BE ACCESSIBLE | WILL NOT YET BE ACCESSIBLE |

| July 23, 2020 by 8:00 AM | NEW ONLINE BILL PAY AVAILABLE | |

| On or After July 23, 2020 |

|