Total Control, Wherever You Go

With Debit Card Controls through the First Financial Bank Mobile App, you can control when, where, and how your debit card is used. With the swipe of your finger, disable your card if it’s lost, set transaction allowances, and assign spending limits from one place. With debit card controls, you can select which limits and alerts YOU find most helpful in managing your card.

Getting Started

Once you open a First Financial Bank Checking Account, simply enroll in Online Banking. Once that is completed, download the First Financial Bank Texas App on your compatible mobile device. If you already have the app, make sure it’s the most updated version. You can access debit card controls through both online and mobile banking.

Using Card Controls

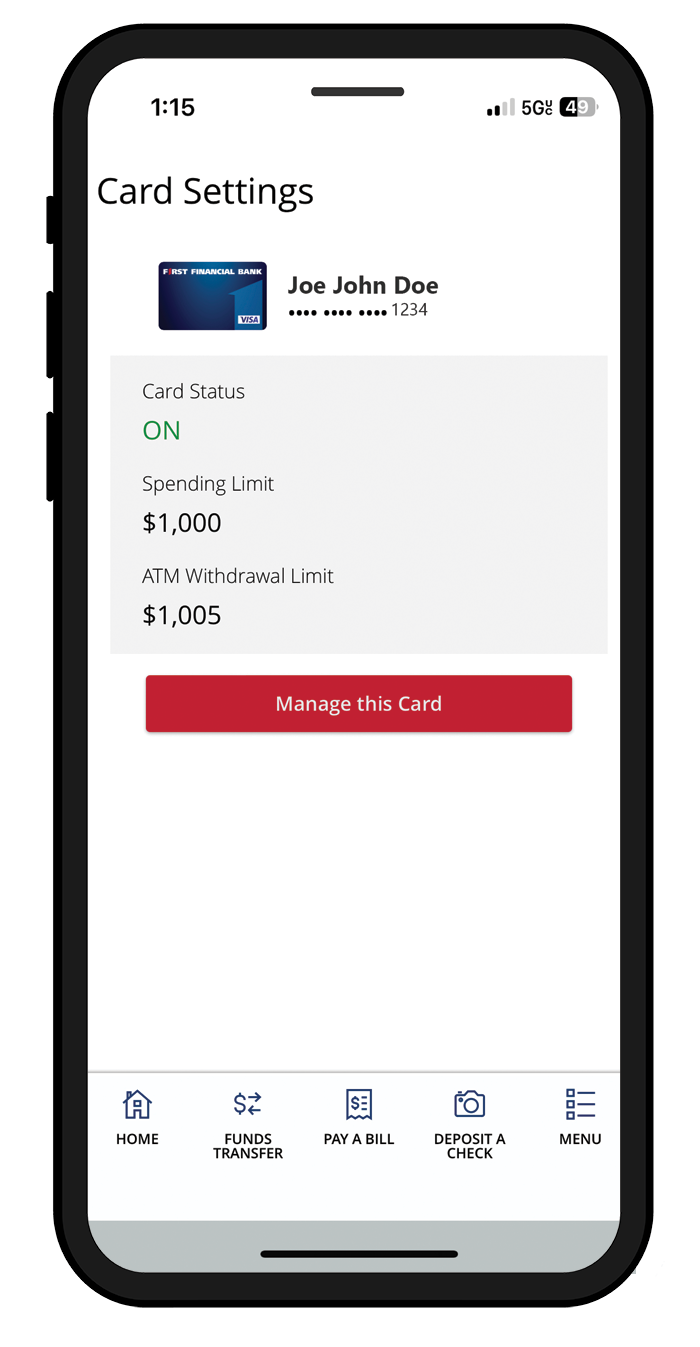

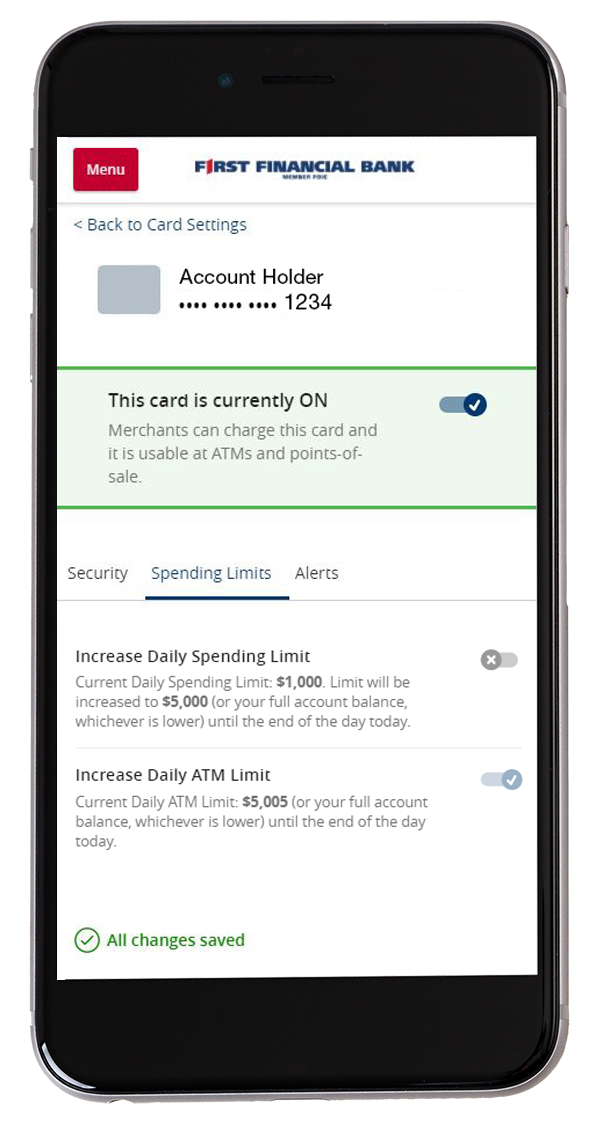

From the homepage of online or mobile banking, scroll down slightly to the Shortcuts section and click the "Card Controls" icon. From there, select the debit card you want to adjust. Once on the debit card controls page, there are three main options: security controls, spending limits, and alert settings.

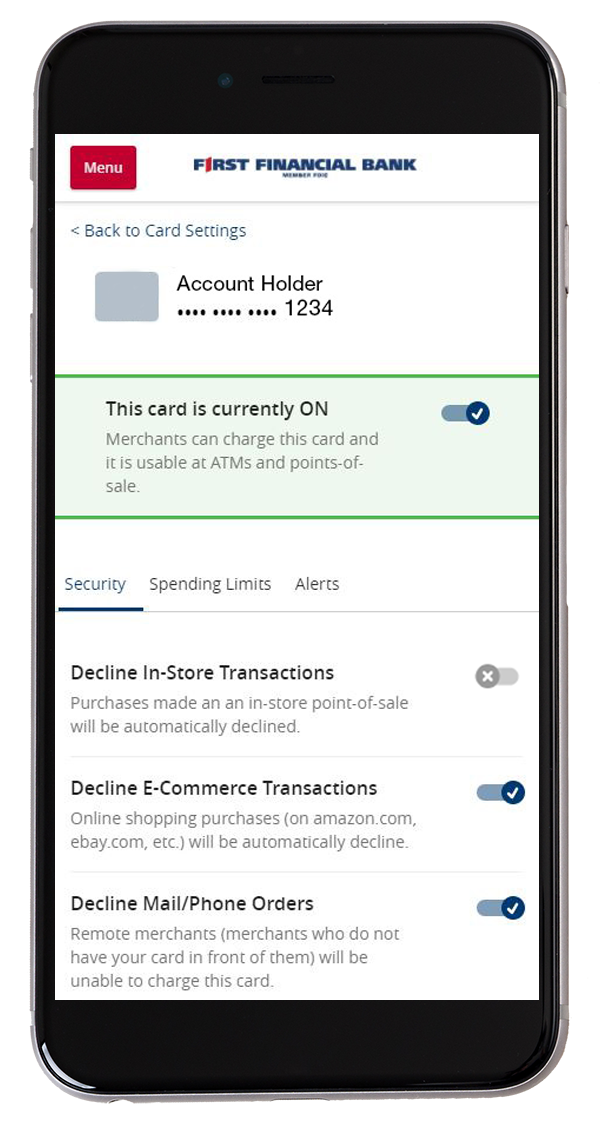

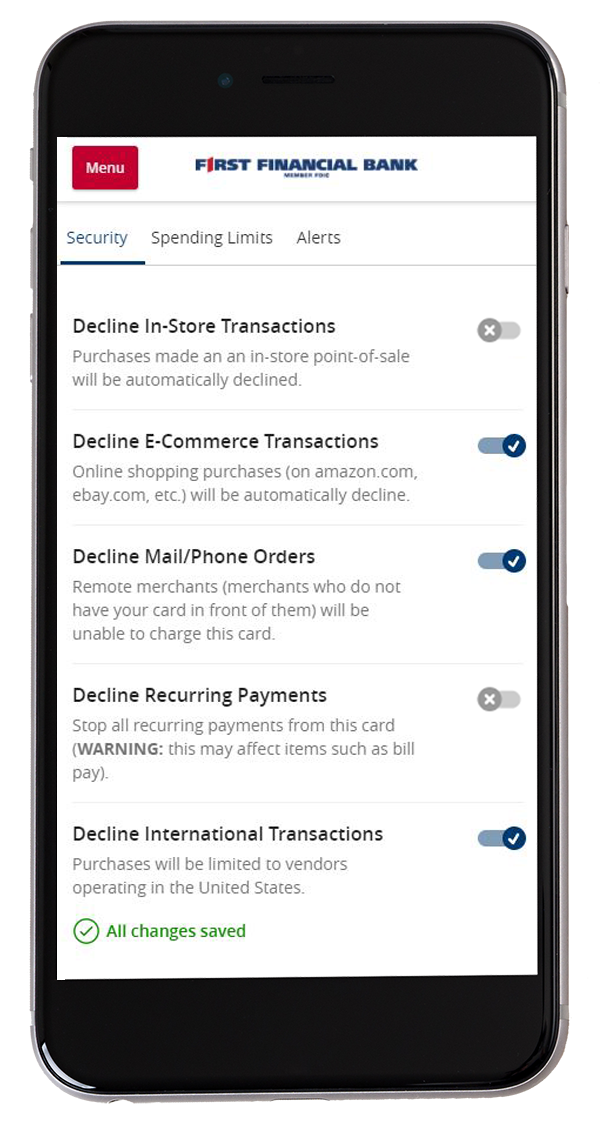

1. Security Controls

Under the security tab, you can make decisions based on your cards functionality. Not a fan of online shopping? You can easily set your card to decline all online transactions!

Here, you can also choose to turn your debit card off. This temporarily declines all transactions until otherwise updated. This is a great option if your debit card is ever lost or stolen.

2. Spending Limits

From the Spending Limits tab, you can temporarily increase your daily spending or daily ATM limit. If you select to increase your daily spending limit, it will increase to $5,000 (or your full account balance, whichever is lower) until the end of the day. The option to increase your daily ATM limit brings your limit to $5005, until the end of the day.

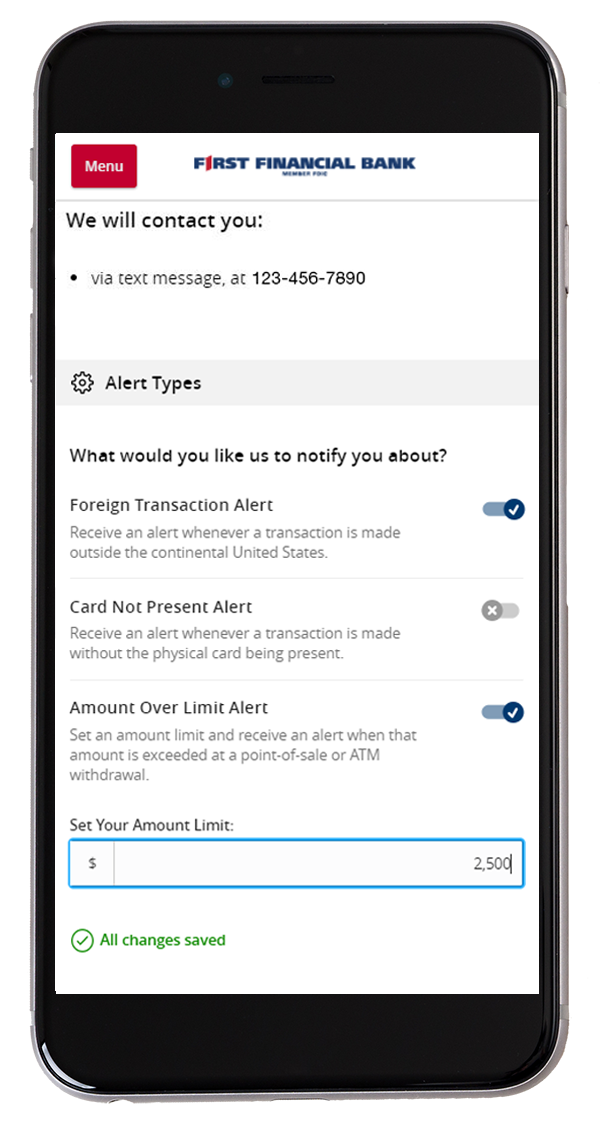

3. Alerts

Under the Alerts tab, you can verify your method of notification. Please confirm that the phone number looks correct to begin receiving debit card alerts.

Here, you can also choose the types of transactions you would like to receive an alert for. Alert types include:

- Foreign Transaction Alert (alert for any transaction made outside the continental US)

- Card Not Present Alert (alert for any transaction made without the physical card being present. For example, online)

- Amount Over Limit Alert (alert anytime your set amount is exceeded at a point-of-sale or ATM)

- Select the amount for which you would like alerts for any purchase that exceeds your limit.