Local Advice. Texas Bankers.

You can receive financial advice from countless national experts, but your unique goals are too important for a one-size-fits-all approach. At First Financial Bank, we are Texas bankers providing advice and solutions for Texans. We live here, work here and shop here, so we understand what's important to you.

Ryan Craig

NMLS #216844

First Financial Mortgage

5057 Keller Springs Rd., Suite 100

Addison, TX 75001

Mortgage Series - Part 3 of 6

Homebuyer Series – Affordability (Capacity)

The next “C” in our Four Cs of homebuying focuses on Capacity, which encompasses affordability, debt-to-income (DTI), and income qualification. Because the most common term used to address capacity is DTI, that is what we will use below. After credit, underwriters usually turn their focus to your ability to repay the mortgage obligation they hope to obtain. Following are ways First Financial will help you narrow down the best DTI for your personal finances and set you up for success.

The origin of DTI goes back to post World War II when the Federal Housing Administration (FHA) and Veterans Administration (VA) created a mass market for 30-year fixed mortgages. These administrations needed a way to determine the best debt level for Americans across all different states. They determined that the total monthly mortgage payment should not exceed 25% of gross income. No consideration was given for additional monthly debt. In the 1970s, FHA established ratios of 28%/36%, known as the front-and-back ratio. The front ratio focused on just the monthly house payment divided into gross income and the back ratio encompassed all debt. With the development of automated underwriting in the 1990s, these long-held standards for DTI slowly started to be phased out. Automated underwriting allowed for other factors to be considered, such as how much down payment was being made, strength of credit score/history, and total assets—allowing DTI to reach as high as 50% in certain situations. Now that you have some background on DTI, let’s get into how you can apply this to your personal decision making.

DTI is calculated based on your total monthly obligations divided into your gross monthly income. For example:

Let’s say you pay $1,000/mo. in rent, have a car payment of $300, and minimum credit card payments of $200/mo. for a total of $1,500/mo. of required obligations.

Your gross income is $4,500/mo., so after dividing $1,500 into $4,500 the resulting DTI is 33%.

What should my DTI be?

You know your budget best, along with your future income potential, spending habits, and financial goals. FHA standards established more than 50 years ago are still a great guide to use as a starting point. With household income of $120,000/year or $10,000/mo., it is completely reasonable to look at a total monthly payment of $2,800 (28% front ratio) with additional monthly debt of $800 for a total of $3,600 (36% back ratio). Also, there are factors where it might make sense to exceed the 28%/36% guidance, but only you know what works best.

Take a look at the bullet points in each category below to see which ones apply most closely to your situation:

Conservative DTI (30% or less)

- Tend to spend more money on eating at restaurants, shopping, travel, higher car payments, or large student loan debt

- In a line of work where income does not significantly outpace inflation, such as hourly workers, teachers, public servant positions

- Cash cushion and assets after closing are 2-3 months of debt obligations

Moderate DTI (31%-39%)

- Possibly in a two-income household, where one of you has upward income mobility at a corporation or through your own business

- Minimal spent on eating at restaurants, shopping, or travel and reasonable car payments as compared to your income

- Cash cushion and assets after closing are 6-12 months of debt obligations

Aggressive DTI (40% & above)

- Career path with high likelihood for upward income mobility, such as high commission or bonus positions, or established self-employment with solid projections for future income

- Very frugal on a monthly basis with spending habits

- Cash cushion and assets after closing are 12 months or more of monthly debt obligations

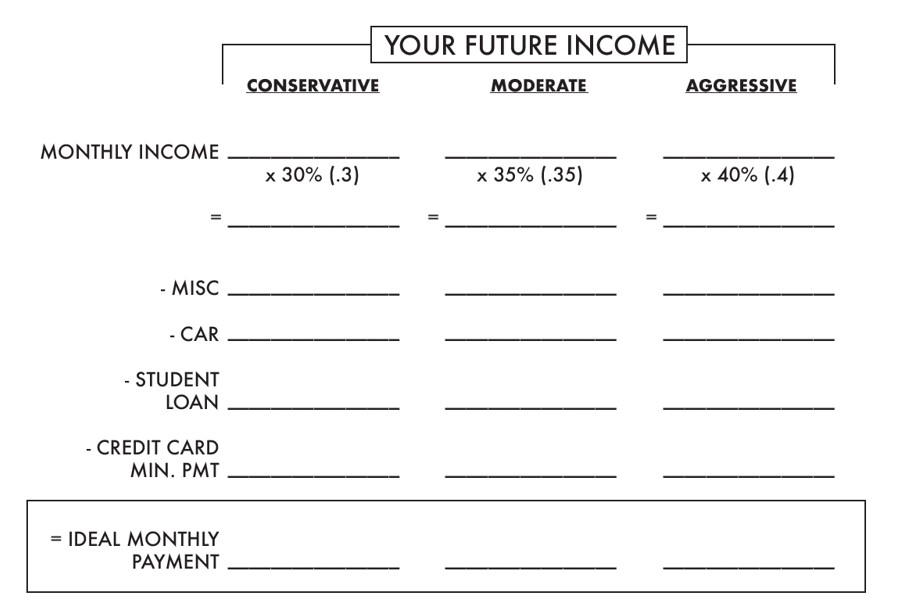

The below chart can help you develop a full breakdown and play around with your own personal numbers to see what works best. Once you have established what monthly payment you are comfortable with, your First Financial Mortgage loan officer can help you see what sales price of property would work based in the areas you are looking!

One important thing to keep in mind as you move through the process of determining the best monthly payment for you: With Freddie Mac reporting the national average mortgage rate at 6.5% at the time of this article, it is important to remember that your monthly principal and interest payment will not go higher when you have a 30-year fixed rate. However, over the last 25 years, the average 30-year fixed mortgage rate is 5.19%. This means over the life of your loan, you might have the opportunity to refinance at a lower rate, creating additional monthly savings. Therefore, if you can find a payment you are comfortable with today, the opportunity to lower that payment in the future could be a possibility. In today’s interest rate market, many are saying, “marry the house and date the rate”!

March 14, 2023

Mortgage Series - Part 2 of 6

Navigating Mortgage Decisions - Credit

The Four Cs of homebuying are critical in every home purchase: credit, capital, collateral, and capacity. These attributes help determine a lender’s ability to get you approved for a home loan. The first area of focus in our Homebuyer Series centers around what may be the most important of the 4 Cs - credit.

Having great credit is important, not just because your parents and grandparents said so. On average, a bad credit score can cost you as much as $2,700 per year; and when it comes to your mortgage, it can be an even bigger number. Let’s break down what contributes to your score and what you can do to position yourself to get the best of the best when it comes to your financing.

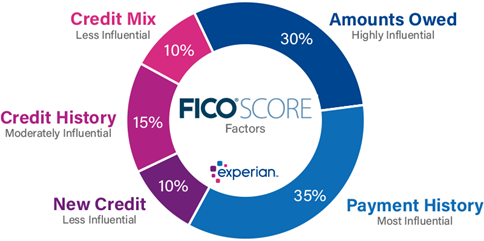

How is your score calculated?

Payment History – You can’t do anything about the past, but you control your future. Setting up accounts on auto-pay can be a huge help in making sure payments are never missed.

Amounts Owed – Making sure credit card balances are less than 30% of the available limit will give you a boost to your score; keeping them under 10% is even better. A high percentage can hurt your score, even if you pay your statement in full each month. Paying your cards weekly is the best way to make sure your balance is as low as possible because you can’t control when the data is reported to the bureaus by the credit card companies.

Credit History – Just like your payment history, it is hard to do anything about how long each account has been open. However, many think they should close accounts they aren’t using. Before you do this, think about how this could impact your score. If there is an old credit card you don’t use but still have open, this could be a great help to your score. Having positive payment history combined with no balance helps tremendously in several categories.

New Credit – When prepping your credit for a home purchase, opening a new account is usually a no-no. One exception would be if you are purchasing the home with a co-borrower. If your spouse or significant other has a great credit history - in particular, accounts that have been open for a number of years - adding you as an authorized user can provide an immediate boost to your score.

Credit Mix – You can have two types of accounts: revolving accounts (credit cards or lines of credit) and installment loans (auto or student loans). Installment loans are important because typically they have a set payment schedule with a set end date, which most closely resembles a mortgage.

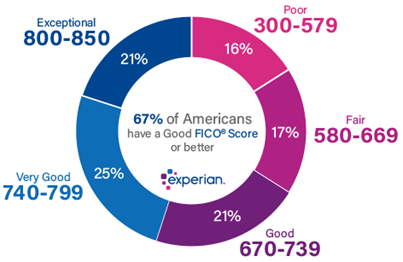

What is a good credit score?

In general, having a “Good” or higher credit score will keep you eligible for a home purchase. The upper end of “Fair” scores might also work, depending on the loan program that ultimately best fits your needs.

How do I know what my credit score is?

Finding your exact FICO score can only happen through a credit pull with your lender. However, there are tools available to help you get a general idea of where you stand. One established site is www.annualcreditreport.com, which allows you to see your credit history. This site will not provide an exact FICO score, but it is a great way to learn who is reporting credit tradelines to the bureaus. Another great tool for First Financial Bank customers is the “View Your Credit Report” option when you login to your online banking home page.

What’s next?

1-4 months before purchasing - Once your mortgage credit report is pulled, it can be used for up to 120 days. This means you are in the proper window if you feel your score is in good shape. So, reach out to your First Financial Mortgage loan officer to start the process for pre-qualification!

4-12 months – Start wiping out those credit cards weekly if you can. If you have been carrying an outstanding credit card balance for a while, start chipping away at it. The more you can pay it down, the better your score will be. If your credit history is limited, talk to a family member about being added to one of their accounts as an authorized user. However, make sure the account to which you are being added maintains a low balance and has a perfect history. Also, think about adding an installment loan if you don’t have one on your credit report already. Your local First Financial banker can help you with a secured loan to help establish some installment credit history.

12 months or more – A year or more gives you ample time to make huge strides with your score. Whether it is cleaning up past mistakes or building a great score for the future, an extended time is always on your side when looking at your credit. Perform some analysis based on the above recommendations; and if you are looking for additional guidance, don’t hesitate to reach out to a loan officer. All First Financial loan officers are trained to assist and advise you on the best possible outcome as it relates to your credit score and mortgage loan. Don’t be shy. We want to hear from you and make sure you are set up for success!

We hope you found this information helpful, and we look forward to the next topic in our series when we will discuss the next “C” of homebuying: Capacity.

February 27, 2023

Navigating Mortgage Decisions - Part 1

When is the best time to purchase a home?

Can I even qualify to purchase a home?

If I own a home, but want to buy my next one, what is the best way to do that?

These are the important, potentially life-altering questions we get every day as mortgage bankers. The answers are different for every individual. Over the next six weeks, we will explain everything you need to know about purchasing your first home, your next home, or your first investment property.

Here are the facts we know about home ownership:

- You control your ability to build wealth. The net worth of a homeowner is nearly 40x that of a renter ($300,000 compared to $8,000).

- You control your future. When renting, someone else owns that property. While they may be a great landlord and you a great tenant, their situation could change causing them to sell the property and you to find a new place to live.

- You control your budget. Your monthly payment on a fixed mortgage doesn’t change. While rent is projected to increase 5.3% in 2023, your monthly mortgage payment won’t go up for the life of the loan.

- You control your memories. Whether a Friday afternoon happy hour in the backyard, Sunday dinner with friends and family, or Christmas morning with your kids - homes are where precious memories are made.

At the end of this series, you will know:

- If it is the right time for you to purchase a home

- If you are financially prepared to purchase a home

- How to put yourself in the best position to purchase a home

- What your total out-of-pocket and monthly payment will be to purchase a home

We look forward to taking this journey with you!

February 13, 2023